The classic definition of a dental practice transition is when a doctor sells all or part of their practice to another dentist. The seller either retires shortly after, or phases themselves out over a period of time. Other names to describe a practice transition include: buy-out, associate buy-in, partnership, or practice sale. But, the transition that is the best deal in dentistry is the practice merger.

Just like a traditional transition, the merger can be structured in many different ways. Two of the most common are:

So why would a buyer want to purchase a merger? Big business figured this out long ago: The quickest way to grow a business with the least amount of risk is through acquisitions.

You have heard the term “mergers and acquisitions.” Bank of America, Chase, and JP Morgan didn’t become massive banks through organic growth, they did it by buying and merging other banks. There are two main economic theories for this operation. First, there are synergies that are gained when you combine two similar operations. Redundant expenses and staff can be eliminated. The result is two gross incomes with one overhead.

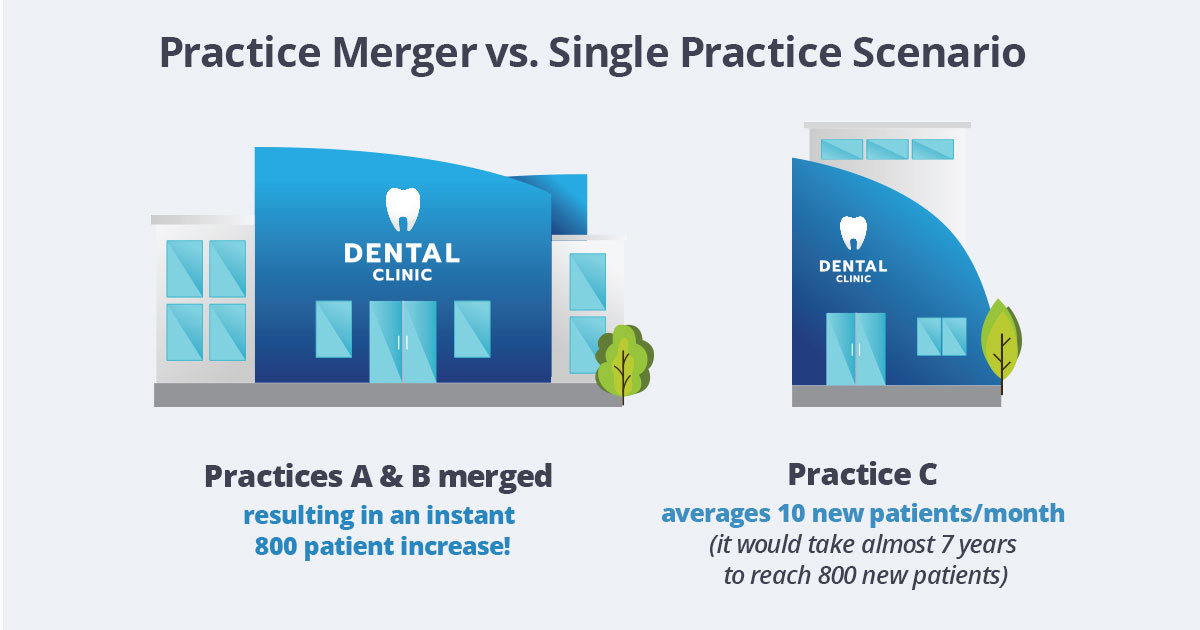

Second, the immediate increase in number of patients.

Let’s take a look…

| Buyer’s Practice – 1800 active patients | Seller’s Practice – 800 active patients | |||

| Gross Income | 600,000 | Gross Income | 384,039 | |

| Wages | 180,000 | Wages | 136,135 | |

| Taxes | 10,415 | Taxes | 13,518 | |

| Rent | 36,000 | Rent | 24,000 | |

| Legal & Professional | 3,000 | Legal & Professional | 1,935 | |

| Insurance | 4,500 | Insurance | 3,208 | |

| Office Expense | 15,000 | Office Expense | 2,412 | |

| Repairs | 4,500 | Repairs | 2,169 | |

| Utilities | 12,000 | Utilities | 5,269 | |

| Telephone | 2,400 | Telephone | 2,819 | |

| Dental Supplies | 36,000 | Dental Supplies | 24,000 | |

| Labs | 30,000 | Labs | 29,051 | |

| Bank Charges | 5,000 | Bank Charges | 3,758 | |

| Marketing | 15,000 | Marketing | 3,000 | |

| Dues & Subscriptions | 1,500 | Dues & Subscriptions | 1,500 | |

| Total Expenses | 355,312 | Total Expenses | 252,774 | |

| Net Income | 224,685 | Net Income | 131,265 | |

| Overhead | 59% | Overhead | 65% | |

When a merger happens, all of the highlighted areas of the purchased practice go away. When you merge the practice into the buyer’s practice, you are only paying one rent, not two. You are only paying one accountant, not two. And so on.

| Buyer’s Practice – 1800 active patients | Seller’s Practice – 2600 active patients | |||

| Gross Income | 600,000 | Gross Income | 984,039 | |

| Wages | 180,000 | Wages | 225,000 | |

| Taxes | 10,415 | Taxes | 11,502 | |

| Rent | 36,000 | Rent | 36,000 | |

| Legal & Professional | 3,000 | Legal & Professional | 3,000 | |

| Insurance | 4,500 | Insurance | 4,500 | |

| Office Expense | 15,000 | Office Expense | 15,000 | |

| Repairs | 4,500 | Repairs | 4,500 | |

| Utilities | 12,000 | Utilities | 12,000 | |

| Telephone | 2,400 | Telephone | 2,400 | |

| Dental Supplies | 36,000 | Dental Supplies | 59,000 | |

| Labs | 30,000 | Labs | 59,201 | |

| Bank Charges | 5,000 | Bank Charges | 8,000 | |

| Marketing | 15,000 | Marketing | 0 | |

| Dues & Subscriptions | 1,500 | Dues & Subscriptions | 1,500 | |

| Total Expenses | 355,312 | Total Expenses | 458,850 | |

| Net Income | 224,685 | Net Income | 525,189 | |

| Overhead | 59% | Debit Service on the loan | 15,776 | |

| Net Income | 509,413 | |||

| Overhead | 52% | |||

When you look at the before and after of the combined practice, it’s like magic! The buyer picked up an additional 800 patients overnight. If you’re getting 10 new patients a month at your practice, it would take almost seven years to reach 800 new patients.

We have completed many “merger” deals and the buyers almost unanimously tell us they were successful. A few patients that once lived in the neighborhood and now travel, may take this opportunity to find a dentist closer, but the vast majority of patients transferred to the new office. As the “new” dentist, you have the opportunity to make a great impression on new patients and give them a good experience that will keep them as patients.

We have completed many “merger” deals and the buyers almost unanimously tell us they were successful. A few patients that once lived in the neighborhood and now travel, may take this opportunity to find a dentist closer, but the vast majority of patients transferred to the new office. As the “new” dentist, you have the opportunity to make a great impression on new patients and give them a good experience that will keep them as patients.

Once a dentist does one of these transitions, it’s not uncommon for them to call us a year later to inquire about other nearby deals and be put at the top of the list to call if any become available.

There is no better feeling, knowing that a transition was a win-win for all involved.

James Ackerman is a dental transitions broker with ADS Midwest. He can be reached at jim@adsmidwest.com or (314) 449-4517.