Basic Understanding of Key Dental Practice Purchase Agreement Elements

Understanding key elements in a dental practice purchase agreement are necessary to ensure a successful dental practice transition. Making the decision to buy or sell a dental practice is a major life event. Once that decision has been made, navigating legal documents can certainly feel daunting. Handling the transaction on the back of a bar napkin or with one of those fill-in-the-blanks contracts is ill-advised, to say the least!

Knowledge of the intricacies of dental practice purchase agreements in one of the most significant decisions of your life, should not fall on your shoulders. Your job is to understand what happens within the operatory. Your attorney and other advisors should guide you through the dental practice transition process.

Whether you are the seller or buyer in a dental practice sale, it is essential to have all the terms and conditions of the dental practice purchase agreement discussed and explained to you by an attorney licensed in the state the practice is located, ideally experienced in dental practice transitions. Failing to do so, you are doing yourself a major disservice as you venture down the road of this milestone in your career. Whether you’re buying a dental practice or in the final stage of your career as a dental practice owner, a successful dental practice purchase will play a big part in your professional career

Nevertheless, having a basic understanding of some elements of the dental practice purchase agreement will be helpful as you begin the process of a dental practice sale or acquisition. With many of these provisions in a dental practice purchase agreement, there is not necessarily a “right” or “wrong”, rather varying degrees of what is ultimately in the best interest and of most importance to each party.

Determining Price and Allocation in a Dental Practice Purchase

Negotiate the Purchase Price

Determining the dental practice purchase price is an essential element of the purchase agreement, however, the purchase is ultimately a function of the terms. Even when the purchase price has been agreed to by the parties, the terms and conditions of this purchase price need to be negotiated. Two offers of $1,000,000 can result in completely different amounts for a seller to ultimately put into their pockets depending on several factors.

- Will the purchase price be paid in cash at closing or is the seller going to be paid via promissory note? Most often, sellers will want the 100% cash at close. While there will be taxes to pay on the purchase price, there are advantages and security in having the cash in hand.

Allocation of Purchase Price

Buyers need to be aware that even though interest rates are higher than a year or two ago, those rates were historic lows. Current rates should NOT dissuade you from making an acquisition! Lenders have a vested interest in ensuring you are going to be successful.

- Allocation of the purchase price determines how the seller will be taxed on the transaction. The final purchase price will be broken down into various categories. Generally speaking, equipment and supplies are taxed at ordinary income rates whereas goodwill is taxed at capital gains rates (typically far lower rate than ordinary income rate). As a result, the seller more often than not, wants as much allocated to goodwill as possible.

If the seller’s entity is organized as a C-Corporation, the tax allocation may have heightened ramifications. C-Corporations are subject to double taxation. Essentially, the purchase price is taxed at the corporate level. Then, when distributed to the owner, it is taxed again at the individual level. Strategies do exist however to alleviate some of that tax burden.

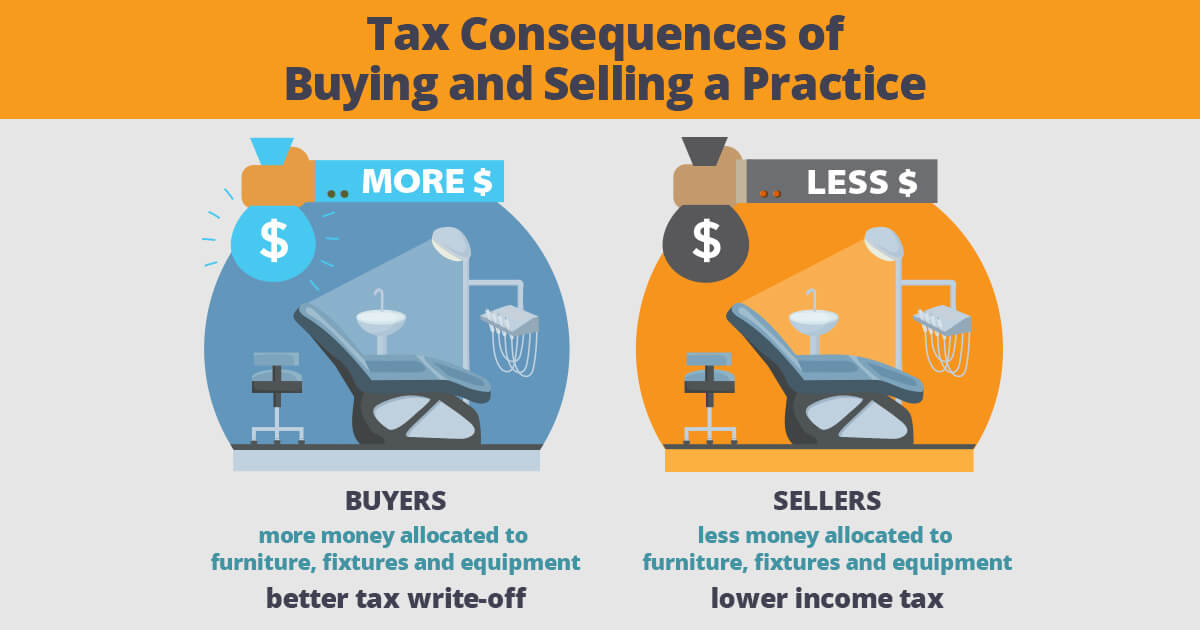

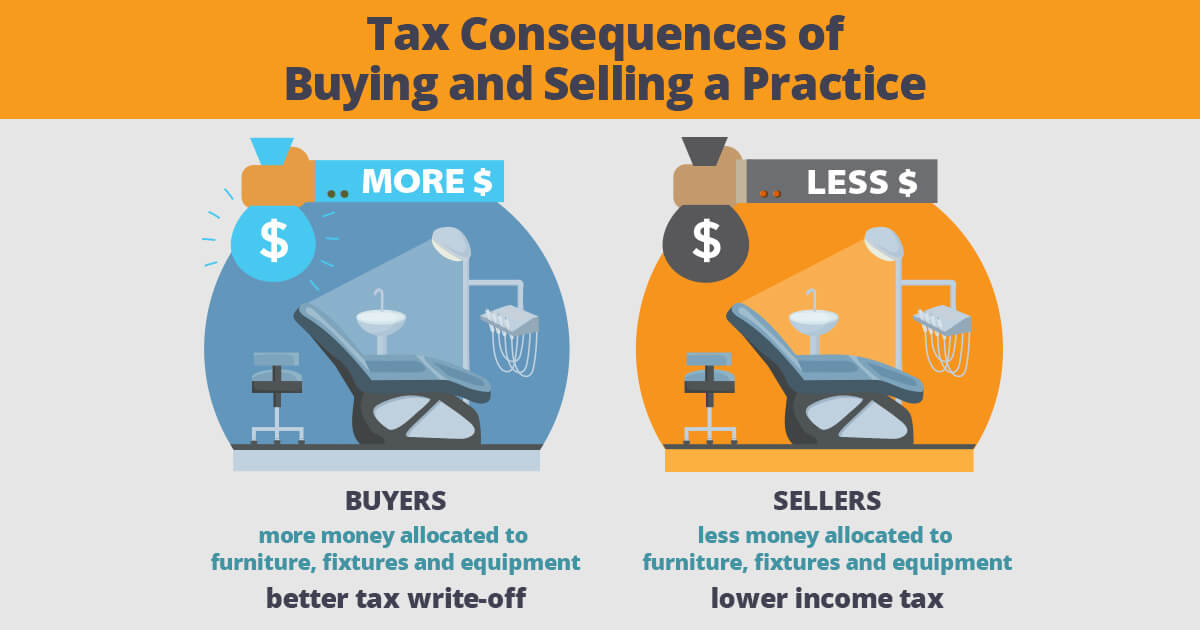

Tax Consequences of Selling a Dental Practice

It is probably not a surprise that what is “good” for the seller, the opposite is true for the buyer. Tax ramifications for the buyer, while important to be aware of, are arguable of less significance than the impact to a seller. The buyer will be able to depreciate the entire purchase price. What differs is the amount of time it takes for the buyer to be able to take advantage of all the depreciation.

The assets taxed at ordinary income rates (equipment, supplies, covenant not to compete) for the seller can be depreciated much faster than those assets that will be taxed at capital gains rates (goodwill). While finding common ground tends to be relatively easy to find, failure to pay attention to the allocation could result in paying thousands more in taxes unnecessarily. It is imperative you discuss the allocation with your accountant or tax consultant.

You Might Like This Article

Conditions to Closing a Dental Practice

It is common to have a series of conditions related to the practice acquisition in the asset purchase agreement. Most conditions will need to be satisfied as of the closing date in order for the closing to occur. Occasionally conditions will be proposed that are obligations of the parties once closing has occurred.

The desired conditions to closing will vary depending on whether you are the seller or buyer. For a seller, generally the fewer conditions to closing the better. You want to limit the reasons a buyer could back out of the transaction so you have assurance that the transaction will ultimately close.

In contrast, as a buyer, while you share the same desire to have assurance that the closing will occur, you may want to have certain things occur either (1) prior to, (2) as part of, or (3) after closing in order to effectuate the closing.

Two Typed of Pre-closing Conditions

There are two pre-closing conditions that are routinely found in asset purchase agreements: (1) buyer’s ability to obtain financing; (2) buyer’s ability to either enter into a lease for the office space or purchase the real estate.

Buyer’s Ability to Obtain Financing

Almost exclusively, a buyer will need to work with a lender to obtain the necessary financing to purchase the practice. The more diligent both buyers and sellers are to promptly provide information to the lender, the quicker the lender can give assurance to the parties that the financing has been approved. Once approved, both sides can have reasonable assurance that this condition is no longer going to be an issue.

Buyer’s Ability to Enter into a Lease

Unless the buyer is purchasing the seller’s practice and merging it into the buyer’s current facility, the buyer will need a facility to practice dentistry. Clearly dental chairs set up in a parking lot will not be very effective! As a result, if the seller currently leases their office space, there will need to be a condition to the transaction that the buyer is able to obtain either a new lease or an assignment of the existing lease from the landlord.

Options for Dental Practice Owners

On the other hand, if the practice owner also owns the building, there are two options available; (1) enter into a lease with the practice buyer; or (2) sell the building to the buyer of the practice.

Dental Practice Valuations as a Pre-Closing Condition

All of these options can take time. Landlords and their attorneys need time to not only draft and negotiate the new lease or assignment, but likely will need to do some due diligence on their prospective new tenant.

If the building is being sold to the dental practice buyer, there will need to be an appraisal of the building performed along with all the required title work. As a result, dental practice valuations are the one condition that often runs well into the time between signing a purchase agreement and the ultimate closing.

It is important that the parties work expeditiously on this condition so as not to delay closing.

Other Pre-Closing Conditions

Other conditions such as seller’s post-closing employment with the practice or an understanding of how retreatment of dentistry will be handled should be addressed as conditions to the transaction, if they are of such importance that the parties will not move forward with the transaction if the parties disagree on some essential terms.

Understanding Dental Practice Purchase Agreements Leads to a Successful Transaction

While what is included in the final purchase agreement is subject to negotiation, having some understanding and perspective on these elements will assist you and your advisors in prioritizing the issues, evaluating what is of real importance to you, thus resulting in terms of a dental practice purchase agreement that allows for the best possible transaction for both parties.

About the Author

Ryan Brengman is a licensed attorney in Minnesota and Wisconsin. He has worked as a dental practice transition specialist with Shea Practice Transitions since 2001. Ryan has had articles published in Dental Economics and Dental Entrepreneur magazines. For over 30 years, Shea Practice Transitions has been serving the dental communities in Minnesota, North Dakota, South Dakota, Iowa, and Wisconsin, helping practitioners navigate the sometimes challenging process of buying or selling a practice.

LinkedIn | Facebook | Instagram