Consider the Tax Consequences When Buying and Selling a Dental Practice

Calculating dental practice taxes can be one of the easier things to deal with during dental practice transitions. This is said because dollar amounts can be planned and calculated.

As a buyer, you are likely going into the decision of purchasing a practice while encumbered by student loan debt. The thought of putting a six or seven-figure debt on top of this is a daunting proposition. However, it is going to be one of the most pivotal decisions you will ever make.

While it may take some time, due consideration, and analysis, eventually you will find the perfect practice for you.

The Tax Consequences of Buying a Dental Practice

Allocation of Practice Price

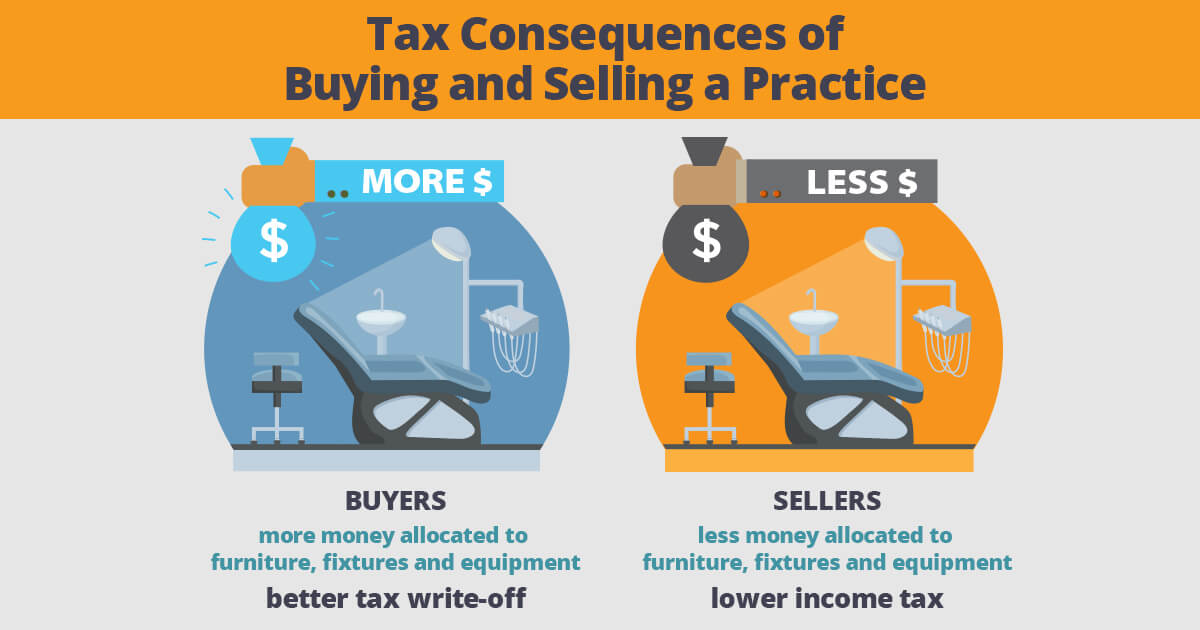

One of the most overlooked parts of the dental practice purchase negotiation is the allocation of the price. From a buyer’s perspective, the better tax write-off option allocates the amount applied toward furniture, fixtures, and equipment. This amount will allow your tax advisor various options on how to depreciate/write off this part of the purchase.

Tax Depreciation

Your tax advisor will be able to look at the options of maximizing Sec. 179 Depreciation election or Bonus Depreciation. These methods allow for a buyer to immediately write off purchase amounts as expenses in the year of purchase. Alternatively, depreciation can be based on the assets’ useful lives, usually for 3 to 7 years.

If you are using current year income or personal funds to pay for the assets, you may consider doing a full, first-year depreciation option (Sec 179 and bonus).

If you have fully financed this portion of the purchase, depreciation over the assets’ useful lives allows you to match expenses in the future.

Remaining Price is Allocated to Client Lists, Goodwill, and Covenants Not to Compete

The remaining amounts from the purchase of a practice are usually allocated to Client Lists, Goodwill and Covenants Not to Compete.

The purchase price for a typical dental practice is classified 75% or more Goodwill. For tax purposes, these items are amortized over 15 years. The allocated amount of these items will be tax deducted equally over15 years.

At first glance, one may not like this, but it is helpful in trying to match debt reduction with an expense write-off.

Deductions From Dental Loan Payments

When a practice purchase is financed with a bank loan, the payments on the loan principle are not tax deductions. Your deduction from the loan payments is the interest paid and the items you purchased with the loan proceeds.

When you are paying down the principle on your loan with income from your practice, you have income that is spent without a direct deduction. However, as mentioned in the last paragraph, the long-term amortization of 15-year items helps to offset these principal payments in future years. These items will not line up exactly dollar for dollar, but it is always nice to have a tax deduction to offset payments on things that are not deductions.

Tax Consequences of Selling a Dental Practice

We’ve discussed tax treatment of a dental practice from a buyer’s perspective. Now let’s look at it from the seller’s point of view. As a seasoned practitioner now ready to sell, and often preparing for retirement, a few items need to be considered and planned for as you move forward.

What Tax Consequences to Consider When Selling a Dental Practice

As mentioned in the allocation for a buyer, your allocation of sales price as a seller will go toward those same items. As a buyer, one will want more money allocated to furniture, fixtures and equipment. Now as a seller, you will want those same items allocated as low as possible. This is because, from a tax standpoint, you will pay ordinary income tax rates on the gain from the sale of those assets.

Dental practice sellers and buyers can look at the hard assets of a practice and come up with a used fair market value. If the two parties cannot agree, then an appraiser can be hired to determine this amount.

Dental practice sellers and buyers can look at the hard assets of a practice and come up with a used fair market value. If the two parties cannot agree, then an appraiser can be hired to determine this amount.

Capital Gains Rates

The balance of the purchase price allocation that goes to the intangible assets of client lists, goodwill and covenant not to compete are taxed at long-term capital gains rates.

In many circumstances, the seller will have zero basis for the sale of these items. This means you will pay tax on the full amount received without reduction.

As of current tax law, you will end up paying tax at either the 15% or 20% federal capital gains tax rate.

State Income Tax

You will also need to consider your personal state income tax implications. These obviously vary from state to state.

Please consult your personal tax advisor as to which bracket you will pay and how your state taxes capital gains.

The Best Time to Close on a Dental Practice Sale

It’s worth noting that a practice sale will ideally happen in a year of little or no other income. In other words, if possible, consider closing the sale of the practice in early January when little if any other income has been made. Using this strategy will keep low tax brackets available to be filled by taxes due on practice sale.

Ted Schumann II and John Looby, CPA are partners of The DBS Companies.

This entry was posted on Tuesday, December 29th, 2020 by Ted Schumann II and John Looby, CPA and is filed under

Taxes,

Dental practice sellers and buyers can look at the hard assets of a practice and come up with a used fair market value. If the two parties cannot agree, then an appraiser can be hired to determine this amount.

Dental practice sellers and buyers can look at the hard assets of a practice and come up with a used fair market value. If the two parties cannot agree, then an appraiser can be hired to determine this amount.