Articles and most recent

Navigating Your First Dental Practice Purchase: Red Flags to Watch For

As a young dentist on the cusp of buying your first dental practice, the Read more>

Dental Practice Due Diligence: What the Buyer Should Know About the Accounts Receivable and Patient Credits

Due diligence is one of the most important jobs for dentists buying a practice Read more>

Five Trends that will Impact Dental Practice Transitions in 2024

As we step into 2024, five trends are emerging that may impact dental transitions Read more>

Don’t Leave Money on the Table: Benefits of Owning a Dental Practice vs Working for Someone Else

There are many compelling benefits of owning a dental practice and ensuring maximum earning Read more>

Understanding Insurance Credentialing in Dental Practice Transitions

The Role of Insurance Credentialing in Dental Practice Transitions Insurance credentialing is a ‘necessary Read more>

13 Reasons Why You Should Be Practicing Rural Dentistry

Big City Lights vs Small City Bites: Why You Should Consider Practicing Rural Dentistry Read more>

Preparing for Your Dental Practice Sale in 5 Years

Retiring and selling your dental practice is one of the most significant events in Read more>

Dental Student Loan Repayment Strategies for 2023-2024

After a delightful 3-year break from payments, as well as interest accrual on student Read more>

Avoid the “Potential” Pitfall When You Sell Your Dental Practice

Selling a dental practice can be challenging and ensuring that you sell your dental Read more>

Creating an Employee Handbook for Dental Practices

Most dental offices are not large enough to have a full-time human resources employee. Read more>

Should You Sell the Accounts Receivable in a Dental Practice Transition?

Should You Sell Your Accounts Receivable? The short answer to this question is yes, Read more>

Five Things Every Dentist Should Know About Disability Insurance

The odds of a dentist experiencing disability is a lot higher than most people Read more>

What is EBITDA?

EBITDA – six letters that can make all the difference in your dental practice Read more>

Understanding Dental Practice Purchase Agreements

Basic Understanding of Key Dental Practice Purchase Agreement Elements Understanding key elements in a Read more>

Is Your Life What You Thought it Would Be as a Dentist?

Remember that first time you didn’t have all summer for vacation? Summers off were Read more>

Women in Dentistry: Why Owning a Practice is the Right Path

I have been a dental practice broker over 20 years now after owning a Read more>

Tactful Tips for Announcing a Dental Practice Transition

Tips for Announcing a Dental Practice Transition Transitioning your dental practice requires balancing the Read more>

Dental School Debt Repayment Strategies for a Smart Future

Dental School Debt Repayment: Smart Strategies for Your Future It’s common for an engagement Read more>

What Can a Buyer do to Ease Negotiations with a Seller?

Make a Good Impression It may sound like common sense, but the best thing Read more>

Navigating the Contracts and Negotiations for a Dental Transition

Contracts, and the negotiations that surround them, are a significant part of the dental Read more>

Should You Build or Buy a Dental Practice?

In today’s economic climate, dentists are becoming increasingly discouraged by the shortage of available Read more>

The Roadmap to a Successful Life After Practice

I agree with Madeleine Albright, former Secretary of State, when she said, “Every step Read more>

Need to Catch up on Your Dental Retirement Savings? Here’s One Way.

Dentists are increasingly getting a late start on saving for retirement. This is often Read more>

What You Need to Know About Private Practice vs. DSO

DSOs are here to stay. They are spreading nationally, and many believe they will Read more>

Is Your Staff Making the Most out of Social Media?

Did you know 63 percent of social media users under the age of 35 Read more>

When Selling a Dental Practice, Make Sure You’re Following Expert Advice

Recently, a retiring doctor perused the website of a large and trusted dental insurance Read more>

Determining the Listing Price of a Dental Practice

The single-most important factor in determining the practice sales price is the collection total Read more>

The Upside of Merging with Another Dental Practice.

Mergers are unquestionably the best return on investment you can make. The success of Read more>

Dental Practice for Sale by Owner

Planning Dental Practice for Sale by Owner Can be Daunting. Take our Quiz to Read more>

Buying a Dental Practice? Here Are Some Important Questions to Get Answered.

Buying a Dental Practice? Consider Asking These Questions First. If you’ve decided to buy Read more>

An Exclusive Sale Listing – Why Would I Do That?

You’re ready to sell your practice and you want the best result possible, so Read more>

Six Questions Every Dentist Should Ask if You’re Thinking of Selling to a DSO

Be Sure to Ask These Six Questions When Considering Selling to a DSO In Read more>

If something happened to you, who would know the value of your practice?

Do you know the value of your dental practice if something were to happen Read more>

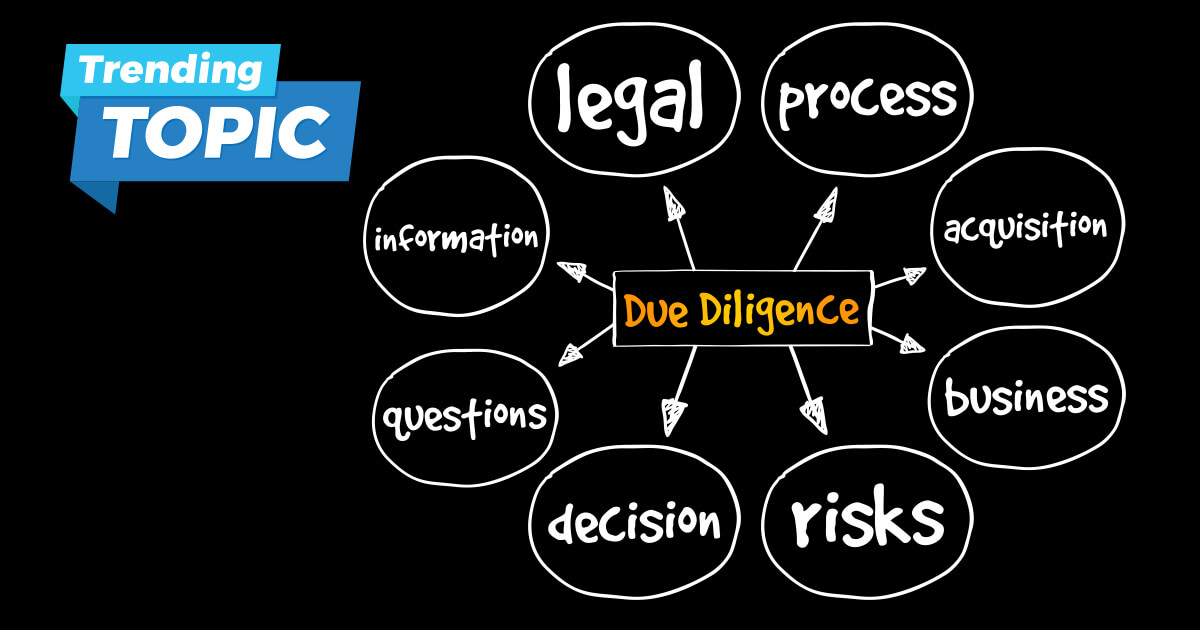

Due Diligence: What does it mean?

Due diligence is a phrase becoming more commonly used by buyers in the market. Read more>

Understanding How Dental Practices are Valued

There are many reasons why dentists might want to have their practices appraised. Some Read more>

Should you sell your dental practice to a DSO?

What is a DSO? A DSO (dental service organization) contract with dental practices and Read more>

Hope for the Best, Prepare for the Worst

None of us want to discuss or think about death or long-term disability. Humans Read more>

10 Reasons Why You Should Use a Dental Broker

Many of us have probably heard from individuals who think sellers don't need a Read more>

Should I Stay or Should I Go?

Life is like a record album for those who remember what that actually is. Read more>

An After-Hour Training Opportunity

Using your practice as a Dental Assisting School The U.S. Bureau of Labor projects Read more>

The Win-Win Practice Transition

The classic definition of a dental practice transition is when a doctor sells all Read more>

The Smart Money is Buying Dental Practices Now!

Investing in a Dental Practice is a Smart Investing Move The United States had Read more>

Dental Practice Financing in a Post-COVID Economy

Whether you are a first-time dental practice owner or someone looking to expand, relocate Read more>

The Cost of Dental Practice Valuation

A dental practice valuation is much like a preventative checkup on your practice’s financial Read more>

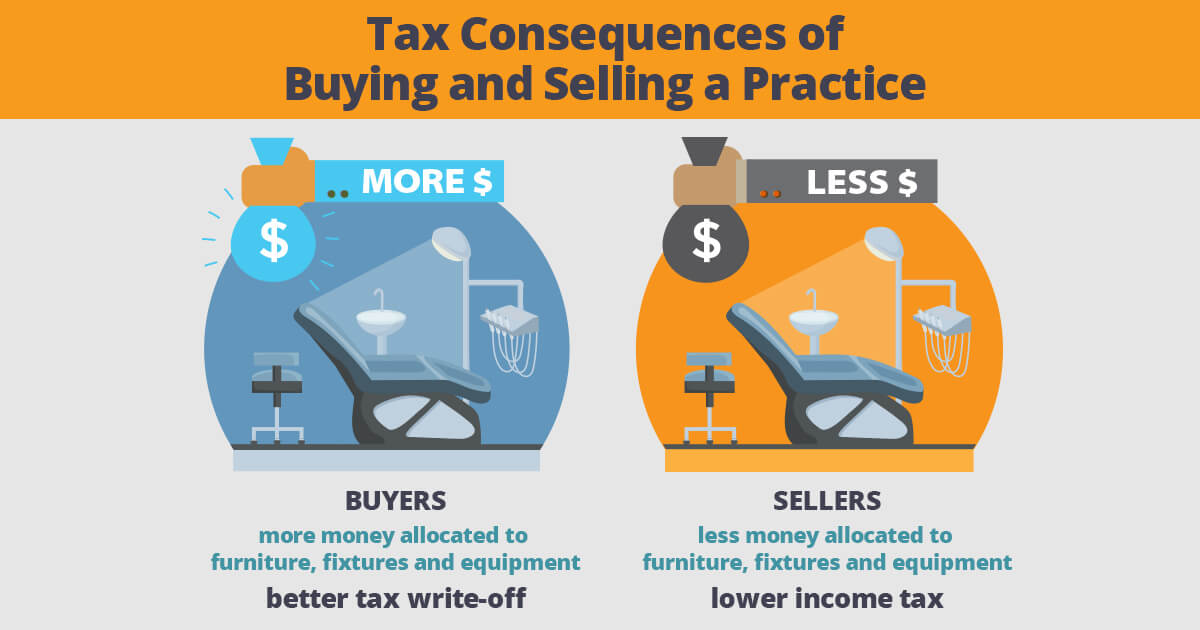

Tax Consequences of Buying and Selling a Practice

Consider the Tax Consequences When Buying and Selling a Dental Practice Calculating dental practice Read more>

Your Multimillion-Dollar Decision

If you’re a dental student or new graduate, you’re going to be faced with Read more>

Avoiding Practice Transition Problems

I would like to share some stories with you concerning a few of the Read more>

Buy a Practice…Now???

COVID-19 has all of us questioning how we move forward. Unfortunately, many will retreat Read more>

Financing for Dental Practices Today

Whether you are a first time practice owner or someone looking to expand, relocate Read more>

10 Tips To Prepare for a Dental Practice Sale

Use Downtime as an Opportunity to Add Value to Your Dental Practice Sale We Read more>

The Advantages and Disadvantages of Selling to a DSO: A Case Study

What are DSOs? DSOs actually go by a number of different names: Dental Service Read more>

Millennial Dentists & Changes in Dentistry

“MILLENNIALS” are people born between 1980 and 2005.1(p3) They’ve grown up in a much Read more>

What Do You Do After Dental School?

Things to Consider After Dental School? After graduating from dental school, you’ll need to Read more>

What are Some of the Best Ways to Sell a Dental Practice?

If you are healthy and just want more free time, you are fortunate to Read more>

How to Start a Successful Dental Practice

WHAT THEY DIDN’T TEACH YOU IN DENTAL SCHOOL Most of us graduated from Dental Read more>

How to Buy a Dental Practice

After completing your formal training and saving money for a down payment, you might Read more>

Things to Look for in Your Associate Dentist Employment Agreement

If you get a job as an associate dentist you are typically confronted with Read more>

Understanding EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

An understanding of the value of a dental practice is essential not just for Read more>

Case Study: Transfer of Accounts Receivable, with a Wrinkle

A recent practice transition that we handled included the purchase of the selling Doctor’s Read more>

The $14,000,000 Decision Every Dentist Must Make

Suppose that when you begin your dental career that you will have to check Read more>

The Dental Practice Transition Period

There are many issues that have to be agreed upon in order to sell Read more>

The Associate Buyout

by Bill Avery, DDS, PhD As happens with most dental practice brokers, I frequently get Read more>

How to Increase the Profits of Your Dental Practice Sale

There are many factors to be considered when attempting to increase the value of your Read more>

11 Steps to Evaluating a Dental Practice

Evaluating a dental practice for sale is a multi-step process. If steps are skipped, problems Read more>

Merging a Dental Practice Basics

Nowadays you can almost assume that most dentists will have to go through the Read more>

Sell Your Practice Now and Stay on After the Sale

What if you could sell your practice and office space at the FAIR MARKET Read more>

Perils for Practice Transition: Double Taxation of Goodwill

For most dental practices, goodwill constitutes the largest component of the practice’s value. A Read more>

The Best Reasons to Own

Today, if you are a dentist and do not own all or part of Read more>